stock market bubble india

Factors suggesting bubble in equity market There was an 81-plus growth in the Sensex between April 2020 and March 2021 in the backdrop of real GDP growth plummeting to -73 during the same period. The earnings cycle of corporate India and the stock market cycles have their unique journey.

We Are Now Officially In A Stock Market Bubble Seeking Alpha

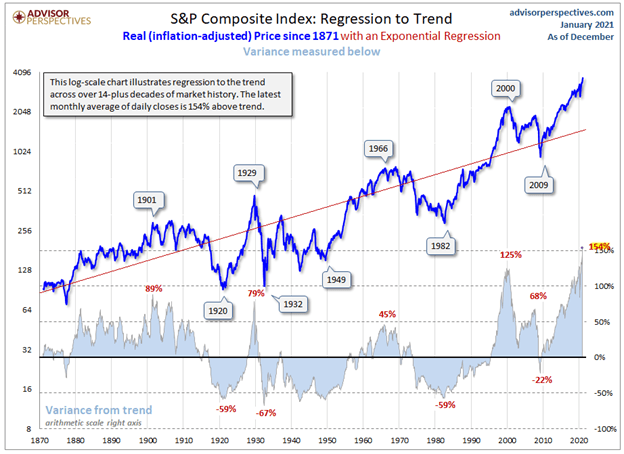

The current upswing in the stock market has already triggered some murmurs of a possible bubble burst in the future.

. The Reserve Bank of India RBI recently warned about a possible stock market bubble in its annual report for FY21. I dont know what is moving the market. Updated May 28 2021 550 PM IST.

He also said the US housing market was a superbubble in 2006 and that the 1989 Japanese stock and housing markets were both superbubbles Read More 2022 hasnt been good for stocks. The Sensex crossed 50000 last week up from 40000 a year. Is the Indian market in a bubble or is the India growth story real.

Bubbles burst invest carefully 28-30 jump in stock market indices over a year has come at a time when the fundamentals of the economy have been disrupted first by demonetisation and then by the hasty implementation of the GST. The Indian stock market has risen close to 100 from the lows of March 2020. The stock market bubble.

While output contraction had reversed from the third quarter of 2020-21 the inflation rate also rose and remained way ahead of the real GDP growth rate in the. Are stocks manipulated by market operators. The fundamentals are bad.

In this context the rapid V-shaped recovery of Nifty and Sensex to lifetime highs has sparked the debate of whether or not we are in a stock market bubble. There can be. RBI predicts a disastrous GDP fall of 75 yet the stock market has soared.

The anatomy of a stock market bubble staring India in the face Premium The 30-share BSE Sensex advanced to an all time high of 4460163 during the day before ending up 1 or 44587 points up. The Reserve Bank of India RBI sees a bubble building in the stock market as prices of risky assets surged across countries to record high levels during the year. The RBI in its recent annual report.

This technique can help identify bubbles as they emerge not just after they have exploded. The equity bubble has now been joined by a bubble in housing and an incipient bubble in commodities 3. With an economy moving slowly along the path of recovery a stock bubble could serve as the most potent risks of the Indian financial sector in the near future calling for a need to exercise precautionary policies that may help cushion such an expected situation and waiting for the markets to eventually show us their outcome.

In a bubble no one wants. The recent surge in stock prices in India sparked off a debate on a possible bubble in the Indian stock market. Lets deconstruct and unders.

Stock Market beginners must understand market cycles. What causes a stock market bubble and how to navigate difficult market conditions. Im being candid here.

Hows does a small investor in India benefit from the economic growth the country is going thru without getting swindled by the big stock market manipulators and FIIs. Mr Punjabi says that the gains Zomato shares accrue on the listing day July 27. The bull run continues even if regulators and a few market experts have already raised the red flag.

The stock market is in a bubble territory with prices being driven by liquidity and not fundamentals Nikhil Kamath co-founder Zerodha True Beacon told Fortune India in an interview. RBI warns of Stock Market Bubble in its newly released Annual Report 2021. The attempt here is to detect and date stamp bubbles present if any in the Indian stock market using a recursive econometric technique.

The country is grappling with a deadly pandemic with the estimated contraction in GDP for 2020-21 close to 8 percent. The central banks comment comes on the back of domestic stock markets touching record highs even as the countrys economy continues to face disruption due to the second wave of the Covid-19 pandemic. The news is bad.

After economic liberalisation in India in 1991 the stock market saw a number of cycles of booms and busts some related to scams such as those engineered by players such as Harshad Mehta and Ketan Parekh some due to global events and a few due to circular trading rigging of prices and the irrational exuberance of investors leading to bubbles that finally burst.

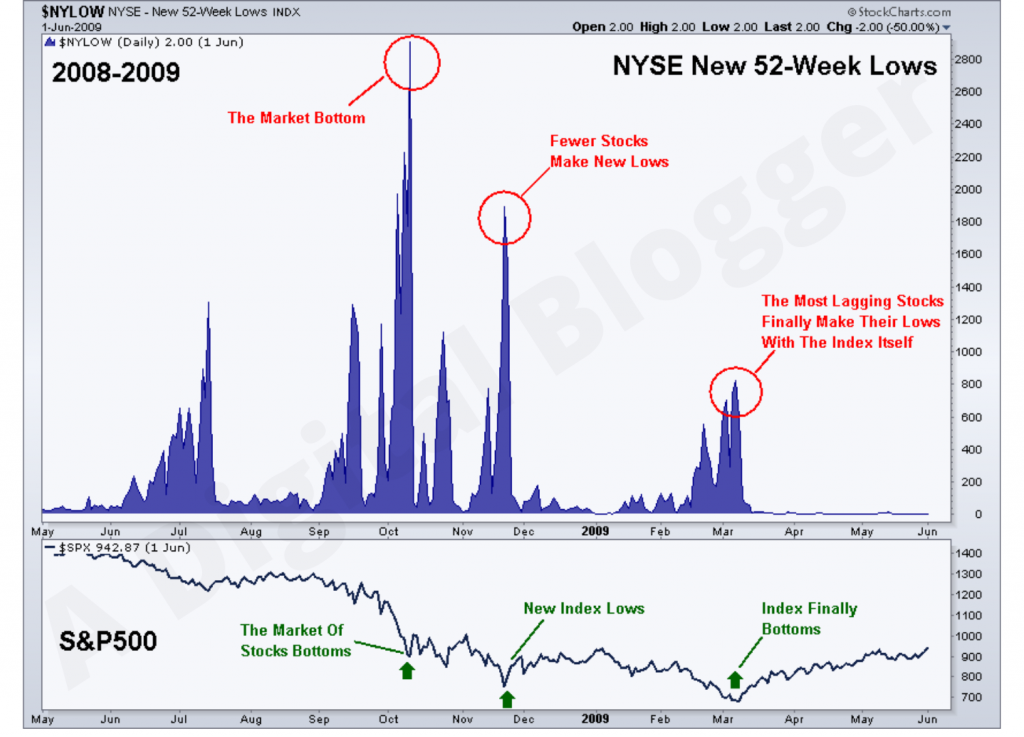

Stock Market Crash 2008 Chart Causes Effects Timeline

Rebooting Economy I Why Stock Market Is Booming When Covid 19 Hit Economy Sinks Businesstoday

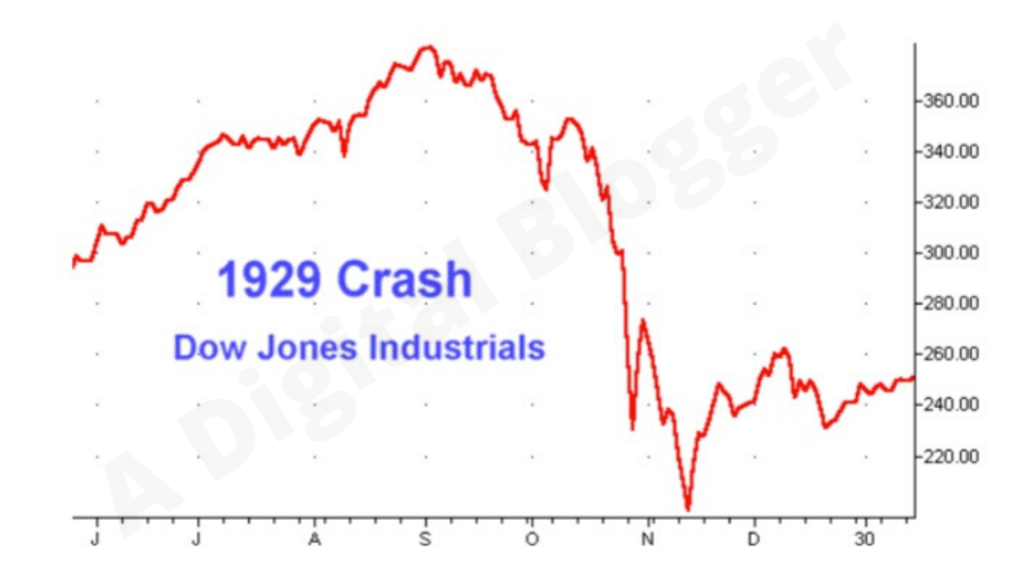

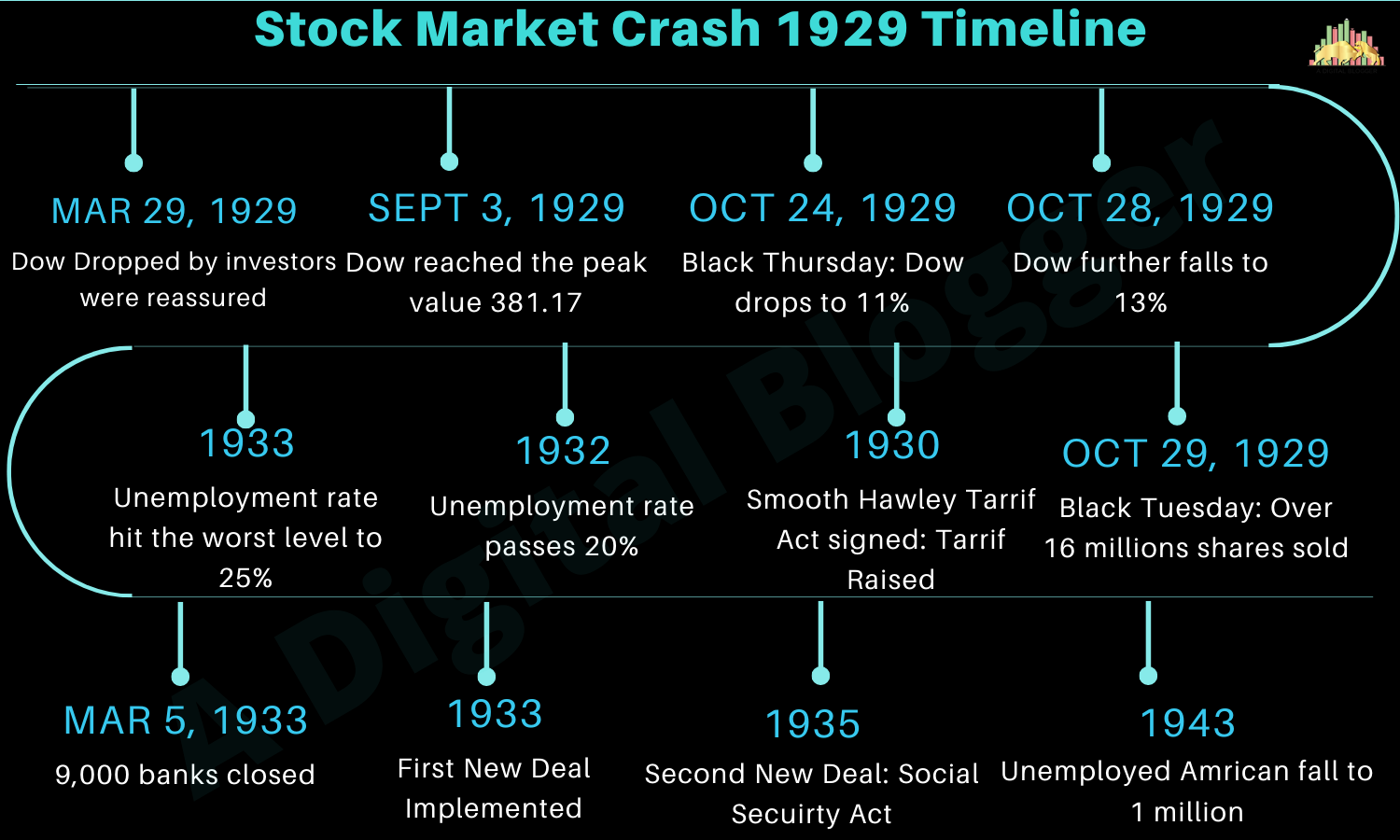

Stock Market Crash 1929 Definition Facts Timeline Causes Effects

10 Biggest Stock Market Crashes In India Trade Brains

Why Did Indian Stock Market Crash In 2020 Causes Effects

Financial Crisis 2008 Subprime Economic Stock Market Crash Indiancompanies In

Stock Market Correction About Falling Share Market Getmoneyrich

10 Biggest Stock Market Crashes In India Trade Brains

Stock Market Correction About Falling Share Market Getmoneyrich

Stock Market Correction About Falling Share Market Getmoneyrich

Stock Markets Protect Your Wealth From Market Bubbles The Financial Express

Stock Market Crash 1929 Definition Facts Timeline Causes Effects

5 Crucial Lessons Learned From Past Stock Market Crashes

Biggest Stock Market Crashes In History The Motley Fool

Pricey Yes But Indian Stocks Not In Bubble Zone

Stock Market Bubble 2021 Reserve Bank Of India Issues Warning Economy Current Affairs For Upsc Youtube

Stock Market Correction About Falling Share Market Getmoneyrich